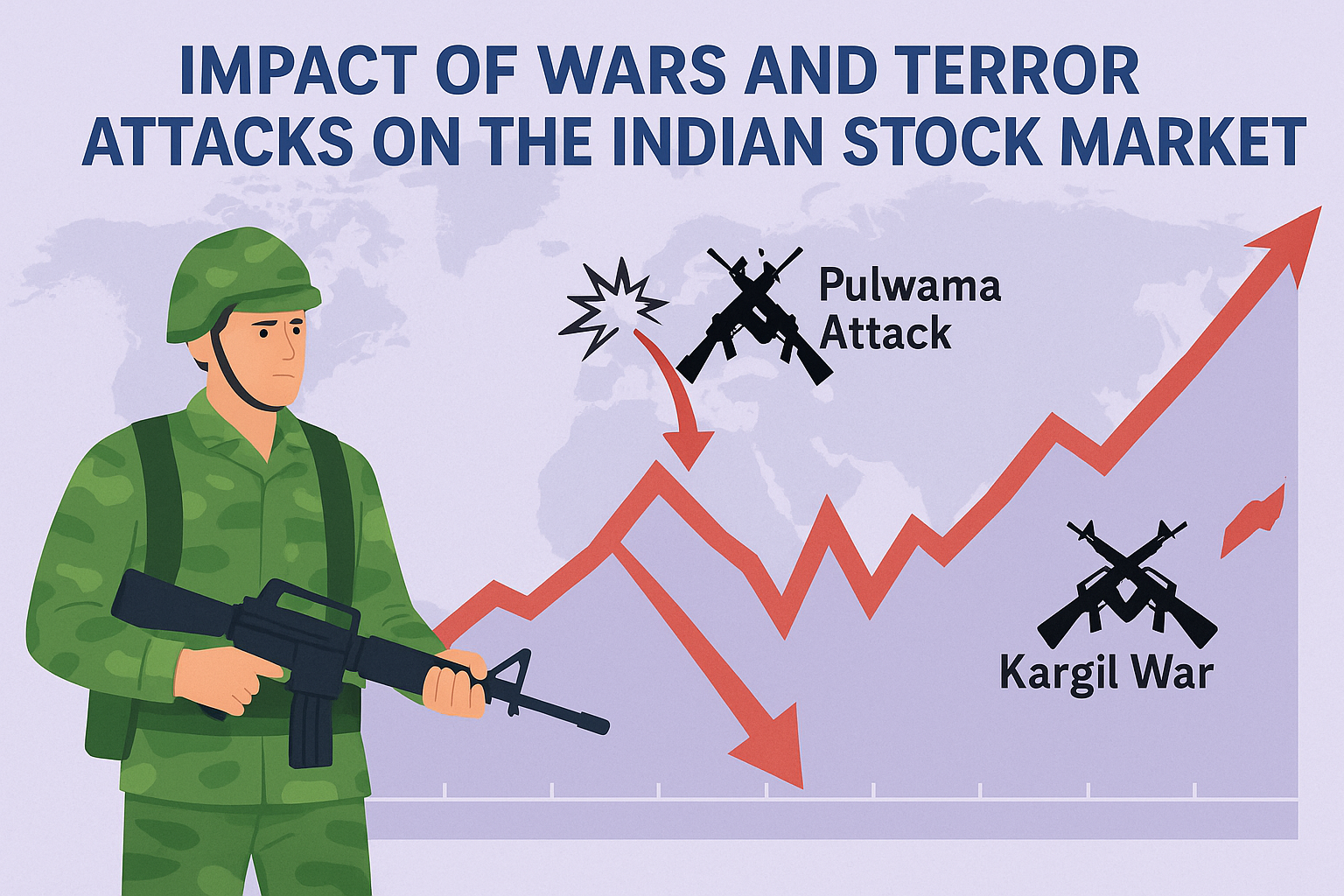

When geopolitical tensions rise—whether due to terrorist attacks or full-blown wars—investors often react with fear, assuming that stock markets will crash. But what does historical data say? Should Indian investors panic, stay invested, or look for buying opportunities?

In this post, we analyze how the Indian stock market has historically responded to significant national security events including the Pulwama attack, Uri attack, 26/11 Mumbai attacks, and even the Kargil war. Let’s separate emotion from logic and learn what history has to teach us.

🇮🇳 Pulwama Attack – Feb 2019

- Date: 14th Feb 2019

- Market Reaction:

- Immediate next day (15th Feb): Down by just 0.2%

- After 2 red days, market resumed its uptrend

- Follow-up Event: Air strikes on 26th Feb, market down only 0.26% on 27th Feb

- Zoomed-Out View: Market was in a strong uptrend; the attack did not reverse the trend

📌 Key takeaway: Temporary dip, but no long-term change in market trend.

🔥 Uri & Pathankot Attacks – 2016

- Pathankot: Jan 2016, market fell nearly 2% and continued downward

- Uri: Sept 2016, initial mild rise of 0.33%, but market resumed its downtrend after a few days

- Surgical Strikes: Market fell 1.76% the next day

- Zoomed-Out View: Markets were already in a downtrend during this period

📌 Key takeaway: Existing bearish trend continued; attacks acted more as accelerators than initiators.

🏙️ 26/11 Mumbai Attacks – 2008

- Date: 26th Nov 2008

- Short-Term Reaction: Sideways movement post-attack

- Zoomed-Out View: Market was already in a strong downtrend due to global financial crisis

- Support Held: Market tested and respected crucial support levels

📌 Key takeaway: The attacks didn’t break existing support. Panic was already priced in due to the financial crisis.

⚔️ Kargil War – May to July 1999

- Timeline: 23rd May to 26th July 1999

- Expected Reaction: Market crash?

- Actual Reaction: Market rallied 37%

- Possible Reason: Market preempted India’s victory

📌 Key takeaway: Contrary to fear, wars may not always lead to crashes. Confidence in national security outcomes can boost investor sentiment.

🕊️ Pahalgam Attack – April 2024

- Date: 22nd April 2024

- Market Reaction: 0.67% up the next day

- Technical Trend: Reversal zone already established; higher highs indicate a bullish shift

📌 Key takeaway: The market seems to be in a recovery phase, and this event hasn’t shaken the trend.

📈 Final Thoughts: Emotion vs. Trend

Across all these events, the core pattern remains the same:

- Short-term dips often occur after attacks or wars.

- Long-term trends are rarely reversed by such events unless the market is already weak.

- Staying invested proves to be the most beneficial strategy over time.

If someone had exited the market fearing a major collapse during the Kargil war, they would’ve missed out on a 37% rally!